Becoming a parent is one of life’s most exciting milestones. Along with the joy and responsibility of raising children, many families find that their housing needs and mortgage priorities change dramatically once little ones arrive. What may have worked for a single person or a couple often needs to be reevaluated when planning for the comfort, safety, and growth of a family.

Becoming a parent is one of life’s most exciting milestones. Along with the joy and responsibility of raising children, many families find that their housing needs and mortgage priorities change dramatically once little ones arrive. What may have worked for a single person or a couple often needs to be reevaluated when planning for the comfort, safety, and growth of a family.

Space Becomes Essential

One of the first priorities for parents is space. Families often seek larger homes with additional bedrooms and bathrooms to ensure that children have their own space and parents have room for future growth. An open floor plan, play areas, or even a finished basement can quickly rise to the top of the wish list as families picture years of activity, homework sessions, and holiday gatherings.

Location Takes on New Meaning

While proximity to work and entertainment might have once been the main factors in choosing a home, parents often focus more on the quality of local schools, safety of the neighborhood, and access to parks, daycare centers, and medical facilities. The right location becomes just as important as the house itself, providing a foundation for daily life and long-term family stability.

Financial Stability Matters More

Parents may look for mortgages with predictable payments, such as fixed rate options, to create stability in their budgets. With the added expenses of childcare, education, and family activities, many parents want to make sure their mortgage aligns with a comfortable monthly payment that leaves room for savings and emergencies. Some families may also explore mortgage products that allow for future flexibility, especially if one parent plans to pause their career or if the household income changes.

Planning for the Long Term

Another important factor is the long-term view of homeownership. Parents often think beyond the immediate present, considering how their home will serve their family over the next decade or longer. Questions like “Will this home grow with us?” or “Is this neighborhood somewhere we want to stay for years?” become central to the decision-making process.

The Big Picture

Ultimately, parenthood changes how families think about housing and mortgages. It shifts the focus from personal convenience to creating a stable, nurturing environment for children. For many, buying a home is no longer just a financial investment but also an investment in their family’s future.

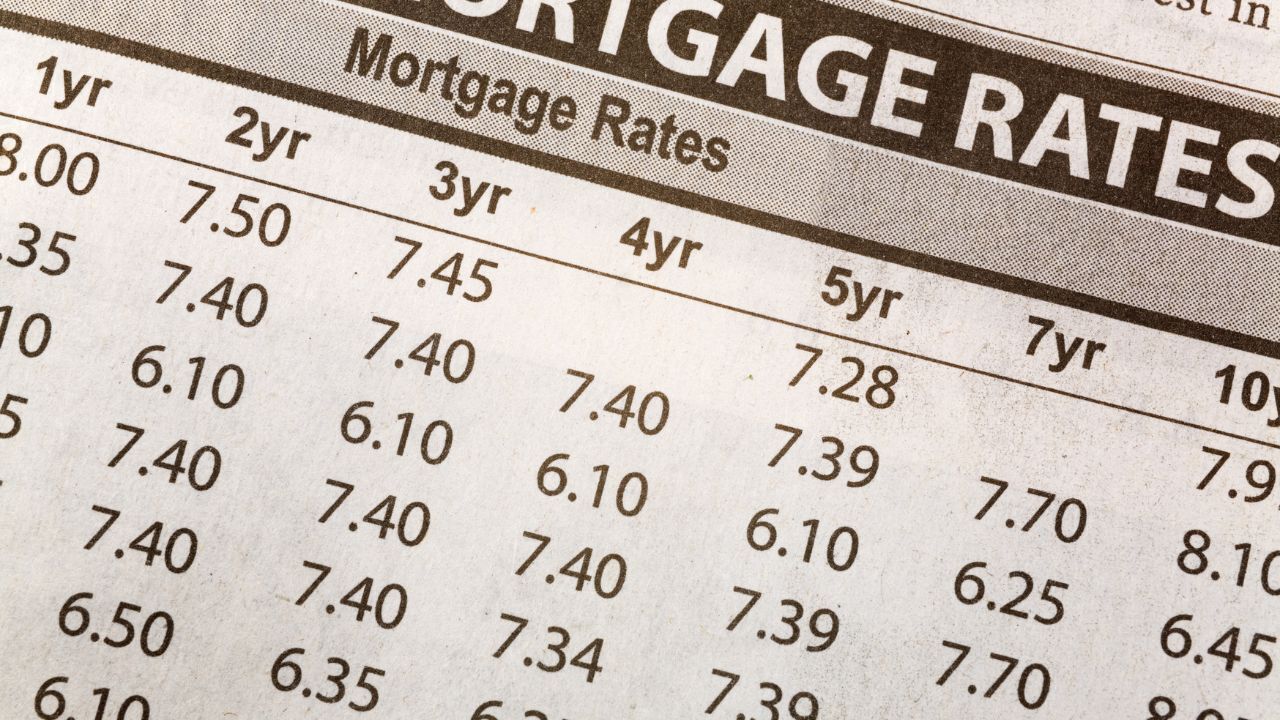

When interest rates climb, homeowners and buyers alike often feel pressure on their monthly budgets. Fortunately, there are strategies that can help you save money and manage your mortgage more effectively even in a rising rate environment. By making thoughtful adjustments and using available tools, you can still work toward long term financial security.

When interest rates climb, homeowners and buyers alike often feel pressure on their monthly budgets. Fortunately, there are strategies that can help you save money and manage your mortgage more effectively even in a rising rate environment. By making thoughtful adjustments and using available tools, you can still work toward long term financial security. Buying a home is exciting, but the thought of monthly mortgage payments can feel overwhelming, especially for first-time buyers. One strategy to ease the financial burden is a temporary rate reduction. This type of mortgage allows borrowers to pay a lower interest rate for the first two years of the loan before it returns to the original fixed rate.

Buying a home is exciting, but the thought of monthly mortgage payments can feel overwhelming, especially for first-time buyers. One strategy to ease the financial burden is a temporary rate reduction. This type of mortgage allows borrowers to pay a lower interest rate for the first two years of the loan before it returns to the original fixed rate. Buying a home is one of the most significant financial decisions you will make. While it is exciting to pick out your dream home, the mortgage process can be complex and stressful. One critical factor that can make or break your journey is your credit. Credit monitoring gives you the insight and control you need to stay on track.

Buying a home is one of the most significant financial decisions you will make. While it is exciting to pick out your dream home, the mortgage process can be complex and stressful. One critical factor that can make or break your journey is your credit. Credit monitoring gives you the insight and control you need to stay on track.