Buying a home is one of the most significant financial steps you’ll ever take. After securing a mortgage, you expect to send your payments to the same lender for years to come. So, when you receive a notice saying your mortgage has been sold and your payments should now go to a different company, it might feel alarming. However, this is a common practice in the mortgage industry, and it doesn’t change the terms of your loan. Understanding why mortgages are sold can help ease any concerns.

Buying a home is one of the most significant financial steps you’ll ever take. After securing a mortgage, you expect to send your payments to the same lender for years to come. So, when you receive a notice saying your mortgage has been sold and your payments should now go to a different company, it might feel alarming. However, this is a common practice in the mortgage industry, and it doesn’t change the terms of your loan. Understanding why mortgages are sold can help ease any concerns.

Why Do Lenders Sell Mortgages?

When a lender issues a mortgage, they provide a large sum of money upfront so you can buy your home. However, instead of holding onto that loan for its entire term, lenders often sell mortgages to other financial institutions. This practice helps free up their capital, allowing them to continue offering new loans to other borrowers.

Mortgages are valuable financial assets, and like any asset, they come with both risks and rewards. By selling mortgages, lenders can reduce risk while maintaining a steady cash flow to finance more home purchases. Many mortgages are sold to government-sponsored enterprises like Fannie Mae or Freddie Mac, which then package them into mortgage-backed securities for investors.

What Happens When Your Mortgage Is Sold?

If your mortgage is sold, you’ll receive a formal notice informing you of the transfer. This notice will include details about your new loan servicer—the company responsible for handling payments and managing your loan. While the entity collecting your payments may change, your loan’s terms, including your interest rate, monthly payment, and repayment schedule, will remain exactly the same.

The only action you need to take is ensuring that you send payments to the correct servicer. Your notification will include instructions on where and how to make payments going forward. If you have automatic payments set up, be sure to update your banking details to avoid any missed payments.

Does This Affect Your Mortgage in Any Way?

For most borrowers, a mortgage sale has little to no impact. You still owe the same amount, your interest rate stays the same, and the length of your loan doesn’t change. In some cases, the new loan servicer may offer different online payment options or customer service features, but the core aspects of your loan remain intact.

While it might seem unsettling at first, mortgage sales are a routine part of the housing market. They allow lenders to keep issuing new loans, making homeownership more accessible to others. If you receive notice that your mortgage has been sold, rest assured that it’s simply a behind-the-scenes transaction that won’t affect your loan terms.

If your mortgage is transferred, don’t panic, just take the time to read the notification carefully and update your payment information as needed. Understanding how the mortgage market works can help you feel more confident in your homeownership journey.

Buying a home in a remote area can be a dream come true—peaceful surroundings, open spaces, and a slower pace of life. However, securing a mortgage for these properties comes with unique challenges. As a mortgage originator, I’m here to break down the hurdles and offer solutions so you can make your rural homeownership dreams a reality.

Buying a home in a remote area can be a dream come true—peaceful surroundings, open spaces, and a slower pace of life. However, securing a mortgage for these properties comes with unique challenges. As a mortgage originator, I’m here to break down the hurdles and offer solutions so you can make your rural homeownership dreams a reality. If you’ve been managing your finances responsibly but don’t have a traditional credit score, you may be wondering whether homeownership is still within reach. The good news? It is! While most mortgage lenders rely on credit scores to assess your creditworthiness, alternative credit history—like rent payments, utility bills, and other recurring expenses—can help you qualify for a mortgage.

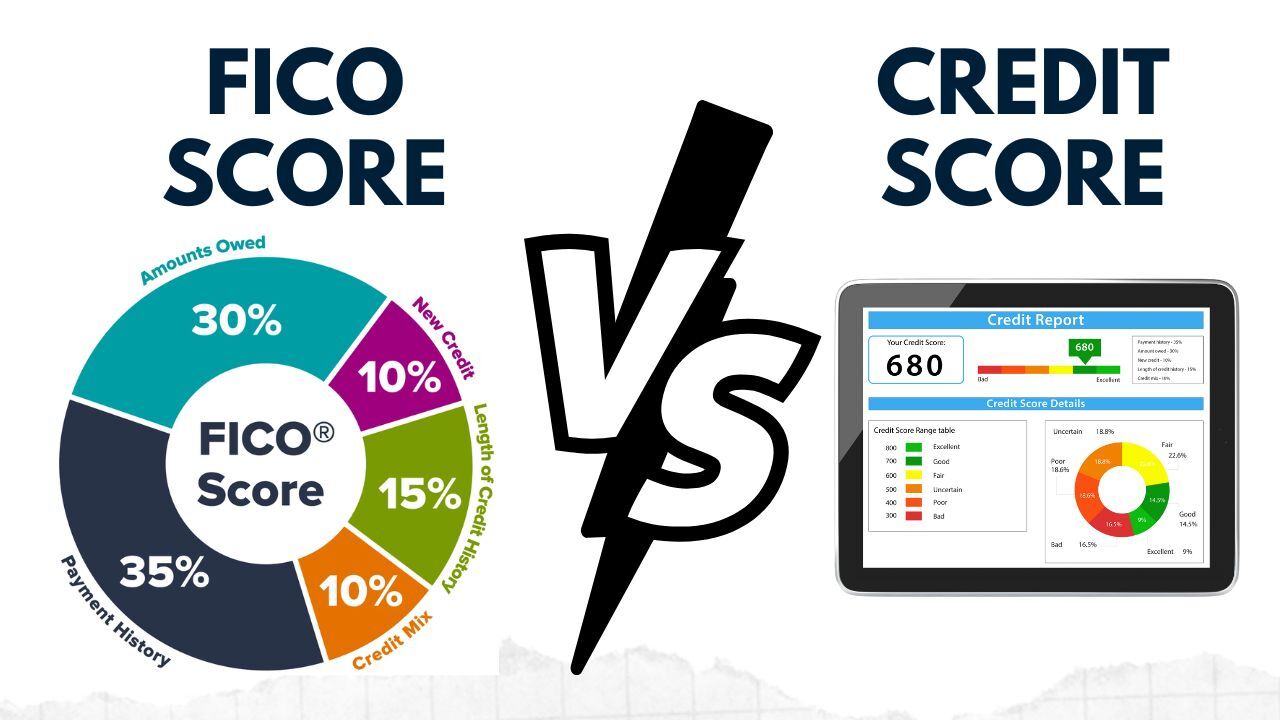

If you’ve been managing your finances responsibly but don’t have a traditional credit score, you may be wondering whether homeownership is still within reach. The good news? It is! While most mortgage lenders rely on credit scores to assess your creditworthiness, alternative credit history—like rent payments, utility bills, and other recurring expenses—can help you qualify for a mortgage. When applying for a mortgage, your creditworthiness plays a significant role in determining your loan approval and interest rates. Two commonly referenced terms are FICO score and credit score, which are often used interchangeably but have distinct differences.

When applying for a mortgage, your creditworthiness plays a significant role in determining your loan approval and interest rates. Two commonly referenced terms are FICO score and credit score, which are often used interchangeably but have distinct differences. Securing a mortgage as a self-employed professional can be more challenging than for traditional W-2 employees, but with the right preparation and documentation, it is entirely achievable. Here’s a guide to help you navigate the process:

Securing a mortgage as a self-employed professional can be more challenging than for traditional W-2 employees, but with the right preparation and documentation, it is entirely achievable. Here’s a guide to help you navigate the process: