Real estate agents are constantly looking for new listings, which will attract potential buyers. We no longer need to limit our search for good listings to planet Earth because Mars is now for sale.

Real estate agents are constantly looking for new listings, which will attract potential buyers. We no longer need to limit our search for good listings to planet Earth because Mars is now for sale.

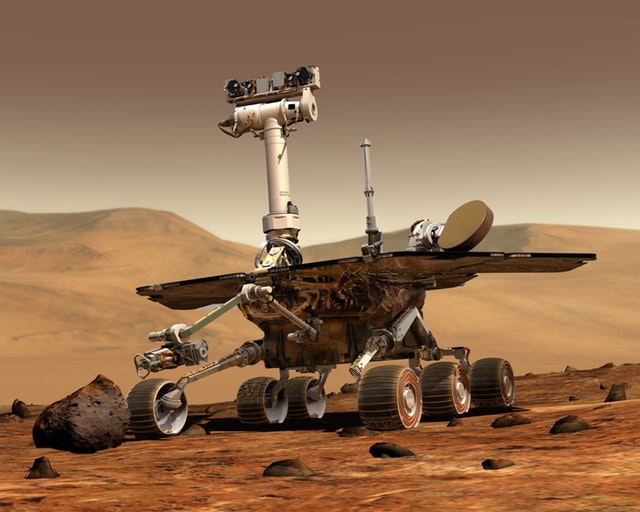

Although this may sound a bit far-fetched at first, it is not such a strange concept if you consider the serious efforts being made to colonize Mars with the commercial efforts by companies like Space X. There is a company, called Lunar Land, which is already selling acres of land on Mars as a novelty.

Historical Precedent

Off-planet land sales have already had considerable success for those crazy enough to sell titles to land on the Moon. Lunar Embassy, which started in 1980, claims to have sold 2.5 million acres of the Moon for about $20 per acre. That’s $50 million in revenues.

This happened in spite of the Outer Space Treaty, which was signed by the US, the UK, and the Soviet Union. The treaty went into force according to Earth’s laws on October 10, 1967. Currently (February 2019), there are 108 countries who signed the treaty and 23 more who signed it but have not yet legally ratified it in their home country.

There is a loophole. There are 195 countries in the world. That means 64 are not a party to the Outer Space Treaty. Any of these countries can legally lay claim to any off-planet real estate according to their own country’s laws.

It’s A Fad Now That Becomes A Reality In The Future

Buying acres of land on Mars is really a fun fad. It has symbolic value but really has no practical value to earthbound persons. In a few decades, this may change.

The estimates by SpaceNews are that it will cost $230 billion to establish a human outpost on Mars with the target date of 2035. Each resupply mission, once every three years thereafter, will cost about $142 billion. The total cost to start the colonization of Mars is about $1.5 trillion.

Mars has about 35 billion acres. That means a commercial colonization program can “own” Mars for only $42.85 per acre.

The Mars Experience On Earth

One way to make this fantasy of colonizing Mars more real is to set up a practice project on Earth. We searched and found the worst, cheapest land in the United States. It is available for purchase at a mere $50 per acre. It is the worst kind of remote desert land with horrific conditions and no natural resources. However, even with the worst Earth conditions, it is a paradise compared to the challenge of living on Mars.

Some clever entrepreneur should create the Mars Habitat on Earth and invite participation to buy land and habitation in a project that develops a workable living space that is self-contained in these harsh desert areas on Earth.

If you are interested in buying a property here on Earth, contact your trusted home mortgage professional to discuss financing options.

Members of the Federal Reserve’s Federal Open Market Committee voted to hold the target range of the federal funds rate to its current range of 2.25 to 2.50 percent. The minutes of the most recent Committee meeting cited softening domestic and global economic conditions as reason for not raising the target federal funds range.

Members of the Federal Reserve’s Federal Open Market Committee voted to hold the target range of the federal funds rate to its current range of 2.25 to 2.50 percent. The minutes of the most recent Committee meeting cited softening domestic and global economic conditions as reason for not raising the target federal funds range. Are you just starting on your real estate investing journey? Many newcomers are surprised to learn that there’s more to making money on the real estate market than buying and selling. These are some of the most popular strategies real estate investors use to create profits. Which one is right for you?

Are you just starting on your real estate investing journey? Many newcomers are surprised to learn that there’s more to making money on the real estate market than buying and selling. These are some of the most popular strategies real estate investors use to create profits. Which one is right for you? Home price indices issued by S&P Case-Shiller showed further slowing in home price growth in January. The national home price index showed 4.30 percent home price growth for the three months ended in January. Analysts expected home prices to grow 4.20 percent for the same period in cities surveyed by Case-Shiller. More cities reported declines in home prices than those that posted gains in home prices.

Home price indices issued by S&P Case-Shiller showed further slowing in home price growth in January. The national home price index showed 4.30 percent home price growth for the three months ended in January. Analysts expected home prices to grow 4.20 percent for the same period in cities surveyed by Case-Shiller. More cities reported declines in home prices than those that posted gains in home prices. Builder sentiment held steady in March as headwinds in housing markets affected homebuilder confidence, but National Association of Home Builders Chairman Greg Ugalde said that builders were looking forward to a “solid spring home-buying season.” Builder sentiment mirrored February’s index reading of 62; analysts expected an uptick to 63.

Builder sentiment held steady in March as headwinds in housing markets affected homebuilder confidence, but National Association of Home Builders Chairman Greg Ugalde said that builders were looking forward to a “solid spring home-buying season.” Builder sentiment mirrored February’s index reading of 62; analysts expected an uptick to 63.