When applying for a mortgage, lenders carefully assess your income and debt to determine your ability to repay the loan. If you receive or pay child support or alimony, these payments can significantly impact your mortgage qualification. Understanding how they factor into your debt-to-income (DTI) ratio, income calculation, and overall loan approval process can help you better prepare for home financing.

When applying for a mortgage, lenders carefully assess your income and debt to determine your ability to repay the loan. If you receive or pay child support or alimony, these payments can significantly impact your mortgage qualification. Understanding how they factor into your debt-to-income (DTI) ratio, income calculation, and overall loan approval process can help you better prepare for home financing.

How Lenders View Child Support and Alimony

Lenders evaluate child support and alimony payments in two key ways:

- If You Receive Child Support or Alimony—These payments may be considered additional income, helping you qualify for a higher loan amount.

- If You Pay Child Support or Alimony—These obligations count as recurring debts and can reduce your borrowing power.

Receiving Child Support or Alimony as Income

If you receive child support or alimony, lenders may allow you to include it as qualifying income under certain conditions:

- Consistency and History—Most lenders require proof that you have been receiving payments consistently for at least six months to a year.

- Continuity—Payments must be expected to continue for at least three years after the mortgage closing.

- Documentation—You will need to provide a divorce decree, court order, or legal agreement detailing the payment terms, along with bank statements or deposit records to verify consistent payments.

When properly documented, child support and alimony can boost your income and improve your ability to qualify for a mortgage. However, if payments are inconsistent or set to end soon, lenders may not count them as reliable income.

Paying Child Support or Alimony as Debt

If you are required to make child support or alimony payments, lenders consider these obligations as part of your monthly debt when calculating your DTI ratio. This can affect your loan approval in several ways:

- Higher DTI Ratio—Mortgage lenders typically look for a DTI ratio below 43%, though some programs allow higher ratios. If child support or alimony payments push your DTI too high, it may limit the loan amount you qualify for.

- Reducing Borrowing Power—Since these payments are viewed as a recurring financial obligation, they lower the amount of mortgage debt you can take on.

- Documentation Required—You must provide proof of your obligation, such as a divorce decree or legal agreement, along with payment history showing you have consistently met these financial responsibilities.

Ways to Improve Mortgage Qualification

If child support or alimony payments impact your mortgage qualification, consider these strategies:

- Lower Your DTI—Pay down other debts, such as credit cards or auto loans, to offset the impact of support payments.

- Increase Your Income—If possible, explore ways to boost your income through a side job, bonuses, or commission-based earnings.

- Explore Loan Options—Some loan programs have more flexible DTI requirements, so working with a knowledgeable loan officer can help you find the best fit.

Child support and alimony payments play a significant role in mortgage qualification, whether you are receiving or paying them. Understanding how lenders view these payments and preparing the necessary documentation can improve your chances of approval. If you re unsure how these obligations affect your home loan, consult with a mortgage professional to explore your best options.

Buying a home is one of the most significant financial steps you’ll ever take. After securing a mortgage, you expect to send your payments to the same lender for years to come. So, when you receive a notice saying your mortgage has been sold and your payments should now go to a different company, it might feel alarming. However, this is a common practice in the mortgage industry, and it doesn’t change the terms of your loan. Understanding why mortgages are sold can help ease any concerns.

Buying a home is one of the most significant financial steps you’ll ever take. After securing a mortgage, you expect to send your payments to the same lender for years to come. So, when you receive a notice saying your mortgage has been sold and your payments should now go to a different company, it might feel alarming. However, this is a common practice in the mortgage industry, and it doesn’t change the terms of your loan. Understanding why mortgages are sold can help ease any concerns. Buying your first home is an exciting milestone, but navigating the mortgage process can feel overwhelming. With so many loan options available, it is important to choose one that best suits your financial situation and long-term goals. Here are three of the most popular home loan programs that first-time buyers should consider.

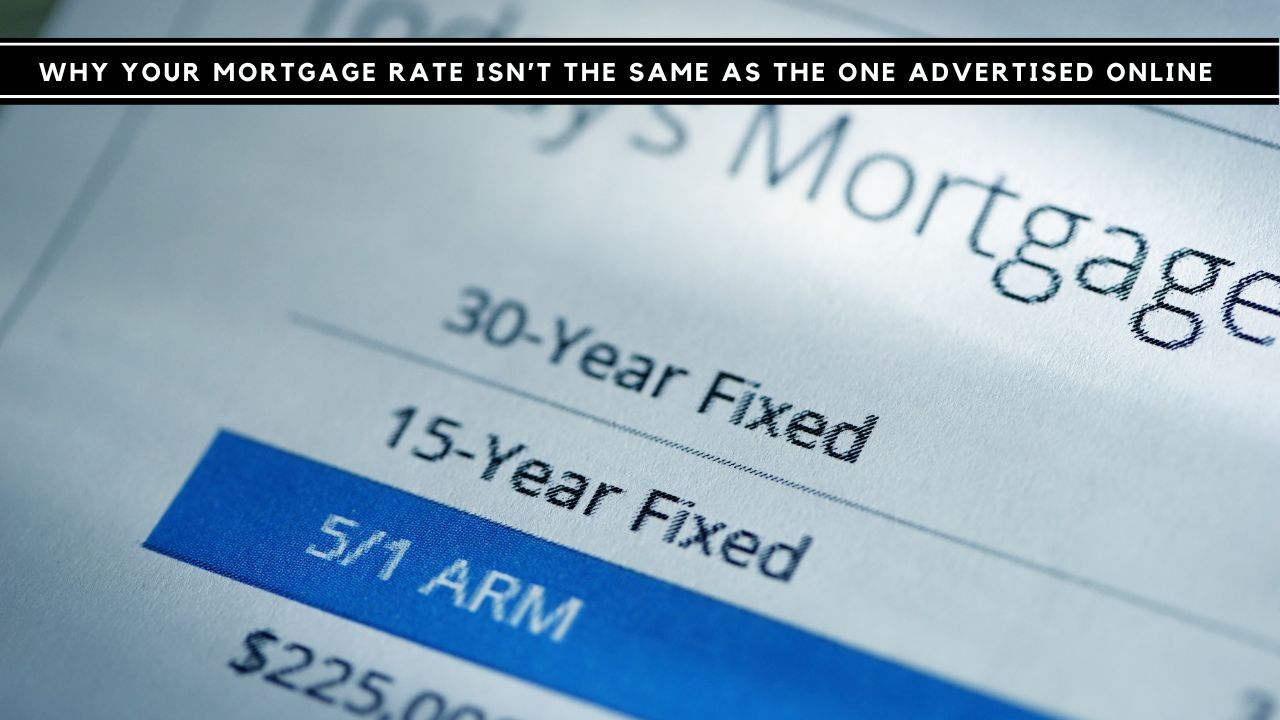

Buying your first home is an exciting milestone, but navigating the mortgage process can feel overwhelming. With so many loan options available, it is important to choose one that best suits your financial situation and long-term goals. Here are three of the most popular home loan programs that first-time buyers should consider. Shopping for a mortgage can be exciting, but it can also be confusing when you see a low advertised rate online, only to be quoted a different rate when you apply. While this can be frustrating, there are several reasons why your actual mortgage rate may differ from what you initially expected. The good news is that understanding these factors can help you make informed decisions and secure the best possible rate for your financial situation.

Shopping for a mortgage can be exciting, but it can also be confusing when you see a low advertised rate online, only to be quoted a different rate when you apply. While this can be frustrating, there are several reasons why your actual mortgage rate may differ from what you initially expected. The good news is that understanding these factors can help you make informed decisions and secure the best possible rate for your financial situation. With rising home prices and strict lending requirements, many aspiring homeowners are looking for creative ways to strengthen their mortgage applications. One potential game-changer? Renting out a room on Airbnb or another short-term rental platform. This additional income stream could help you qualify for a mortgage and make homeownership more affordable.

With rising home prices and strict lending requirements, many aspiring homeowners are looking for creative ways to strengthen their mortgage applications. One potential game-changer? Renting out a room on Airbnb or another short-term rental platform. This additional income stream could help you qualify for a mortgage and make homeownership more affordable.